Bookkeeping

This function allows the cross-referencing of bookkeeping information with the fiscal documents present on the tool and searches the critical reports at any moment.

This action helps verify possible adjustments when there’s still viable time for corrections. Perform this procedure before issuing your definitive bookkeeping to the tax authorities. This is a function of the advanced version of Systax DFE. Talk to your sales consultor to upgrade your package.

Cross-referencing information from EFD ICMS/IPI and EFD Contributions with your fiscal documents

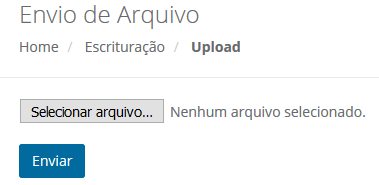

Go to the Bookkeeping option >> Upload, as shown in the image below. Click the button to choose your file, then send it. The system will process the report automatically and will be available on the tool itself, on the results page, to be downloaded. The file format of the bookkeeping file uploaded into the system must be a .TXT file, or a compressed .zip file.

Results (Cross-referencing report EFD x XML)

It’s the result of cross-referencing data from the electronic fiscal documents with the bookkeeping files (EFD ICMS/IPI and EFD Contributions) uploaded into the system, showing the following indicators:

-

XML without EFD: The receipts are in the system, but do not appear in the bookkeeping file;

-

EFD without XML: The receipts that were subjected to bookkeeping, but were not found in the system;

-

Cross-referencing: Cross-referencing of the value fields in the bookkeeping files and the values effectively present in each XML, Looking for divergencies of the header of the documents or items.

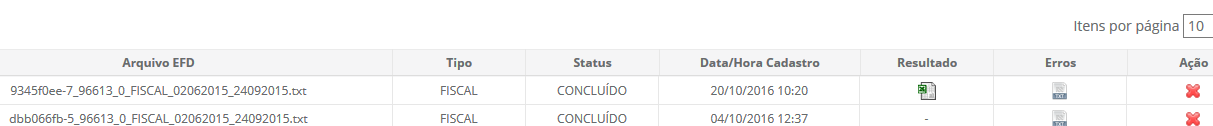

After uploading, the user will have a backup of stored bookkeeping files in the system, which the cross-referencing status can be followed upon and, after its finished, can be downloaded in a cross-referencing file, all on the same page, by clicking the icons present in the results column and the errors column, as seen below.

All uploads and their respective results will be gathered together on each upload, and can be accessed and downloaded at any point, as many times as wanted.

Observation: We also have an option for a service (Fiscal Diagnosis), where consulting jobs are performed, and by which are sent the EFD ICMS/IPI and EFD Contributions document(s), cross-referencing the data present in your EFD with our base of tax rules.

On the Fiscal Diagnosis, there’s the gathering of credit and/or debt values, assessed in your fiscal obligations.

The Fiscal Diagnosis analysis is not performed online and happens within a 30-day period. For more information, please contact us.