Documentação Geral

TaaS – API Trace

API Trace

Por Carlos Cornejo

A API trace tem o objetivo de mostrar o fluxo completo do Tass, desde o envio, até o retorno do Motor para o Tass. Ela tem como principal característica devolver as informações da chamada e retorno do Tass, chamada e retorno do Motor de Cálculo, além da Determinação de Perfil que foi feita.

Como o próprio nome da API já diz, Trace significa percurso, e é exatamente isso que ela faz, mostra o percurso completo.

Acessos para a API

URL: https://wscockpit.systax.com.br/TaaSPD/api/Trace/List

Método: POST

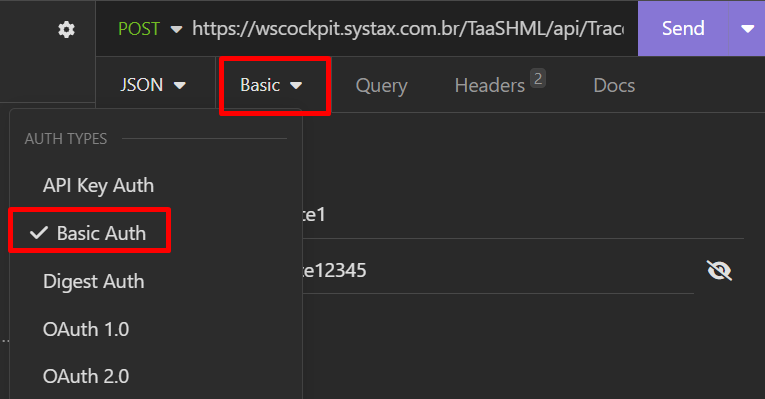

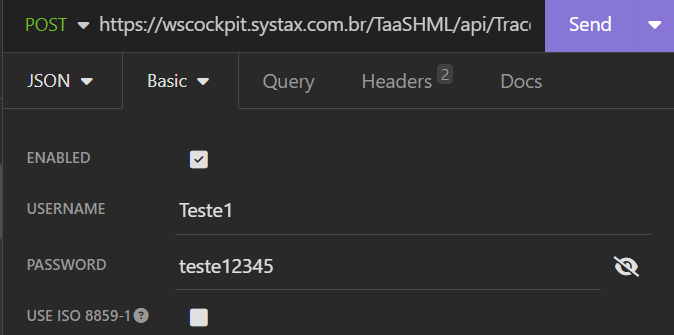

Autenticação

Para utilizar a API é necessário autenticar pelo método Basic Auth e informar as mesmas credenciais utilizadas no Motor de Cálculo.

Chamada

Os parâmetros possíveis para preenchimento na chamada são:

"sessionId": consulta pelo ID da chamada no TaaS (não é obrigatório)

"year": informar sempre o ano da chamada (obrigatório)

"month": informar sempre o mês da chamada (obrigatório)

"pageSize": itens por página (não é obrigatório)

"page": número da página a ser consultada (não é obrigatório)

"ondemandFilter": informar 0 ou 1 (0 – sem ondemand /1 – com ondemand) (não é obrigatório)

"profileFilter": informar o número do ID da planilha de determinação de perfil (não é obrigatório)

Importante: com exceção dos campos obrigatórios, caso não queira informar um determinado parâmetro, basta não informar o campo na chamada.

Modelo da chamada

A chamada é feita na seguinte estrutura:

{

"sessionId": "string",

"year": 0,

"month": 0,

"pageSize": 0,

"page": 0,

"ondemandFilter": 0,

"profileFilter": 0

}

Retorno da chamada

O retorno da chamada será na seguinte estrutura:

- Chamada do Tass

- Retorno do Tass

- Determinação de Perfil

- Chamada do Motor

- Retorno do Motor

- Filtros da Determinação de Perfil

Exemplo de Retorno (com destaque para o início de parte)

[

{

"sessionId": "005056AB1BC71EDE9E8916260C04D7CA",

"user": "Teste1",

"requestedDate": "2023-10-31T23:53:47.08",

"taasRequest": {

"id": "005056AB1BC71EDE9E8916260C04D7CA",

"date": "2023-10-31T18:53:15Z",

"saleorPurchase": "s",

"operationNatureCode": "2GT",

"grossOrNet": "n",

"currency": "BRL",

"items": [

{

"id": "000010",

"itemCode": "81720663",

"itemType": "M",

"quantity": "210.000",

"unitPrice": "7.675480000000",

"itemClassifications": [

{

"itemStandardClassificationSystemCode": "ean",

"itemStandardClassificationCode": "17500435036754"

},

{

"itemStandardClassificationSystemCode": "ncm",

"itemStandardClassificationCode": "30045030"

}

],

"additionalItemInformation": [

{

"type": "commercialQuantity",

"information": "1.000"

},

{

"type": "materialOrigin",

"information": "2"

},

{

"type": "ownProduction",

"information": "N"

},

{

"type": "usage",

"information": "C"

},

{

"type": "CPRB",

"information": "N"

}

],

"costInformation": null

}

],

"locations": [

{

"type": "SHIP_FROM",

"addressLine1": "ROD PRESIDENTE DUTRA, KM 316,",

"zipCode": "27580-000",

"city": "ITATIAIA",

"state": "RJ",

"country": "BR"

},

{

"type": "SHIP_TO",

"addressLine1": "QUADRA 18, CASA 25 25, Setor E",

"zipCode": "64010-430",

"city": "TERESINA",

"state": "PI",

"country": "BR"

}

],

"party": [

{

"id": "1",

"role": "SHIP_FROM",

"taxRegistration": [

{

"locationType": "SHIP_FROM",

"taxNumber": "4646001",

"taxNumberTypeCode": "CNAE"

},

{

"locationType": "SHIP_FROM",

"taxNumber": "01358874001311",

"taxNumberTypeCode": "CNPJ"

},

{

"locationType": "SHIP_FROM",

"taxNumber": "Y",

"taxNumberTypeCode": "COFINSContributor"

},

{

"locationType": "SHIP_FROM",

"taxNumber": "3302254",

"taxNumberTypeCode": "IBGECode"

},

{

"locationType": "SHIP_FROM",

"taxNumber": "Y",

"taxNumberTypeCode": "ICMSContributor"

},

{

"locationType": "SHIP_FROM",

"taxNumber": "Y",

"taxNumberTypeCode": "ICMSSTContributor"

},

{

"locationType": "SHIP_FROM",

"taxNumber": "78863692",

"taxNumberTypeCode": "IE"

},

{

"locationType": "SHIP_FROM",

"taxNumber": "N",

"taxNumberTypeCode": "IPIContributor"

},

{

"locationType": "SHIP_FROM",

"taxNumber": "Y",

"taxNumberTypeCode": "ISSContributor"

},

{

"locationType": "SHIP_FROM",

"taxNumber": "2062",

"taxNumberTypeCode": "legalNature"

},

{

"locationType": "SHIP_FROM",

"taxNumber": "Y",

"taxNumberTypeCode": "PISContributor"

},

{

"locationType": "SHIP_FROM",

"taxNumber": "3",

"taxNumberTypeCode": "taxRegimenCode"

},

{

"locationType": "SHIP_FROM",

"taxNumber": "Real Profit",

"taxNumberTypeCode": "taxDeclarationType"

}

]

},

{

"id": "2",

"role": "SHIP_TO",

"taxRegistration": [

{

"locationType": "SHIP_TO",

"taxNumber": "88925730391",

"taxNumberTypeCode": "CPF"

},

{

"locationType": "SHIP_TO",

"taxNumber": "N",

"taxNumberTypeCode": "COFINSContributor"

},

{

"locationType": "SHIP_TO",

"taxNumber": "2211001",

"taxNumberTypeCode": "IBGECode"

},

{

"locationType": "SHIP_TO",

"taxNumber": "N",

"taxNumberTypeCode": "ICMSContributor"

},

{

"locationType": "SHIP_TO",

"taxNumber": "N",

"taxNumberTypeCode": "ICMSSTContributor"

},

{

"locationType": "SHIP_TO",

"taxNumber": "N",

"taxNumberTypeCode": "IPIContributor"

},

{

"locationType": "SHIP_TO",

"taxNumber": "N",

"taxNumberTypeCode": "ISSContributor"

},

{

"locationType": "SHIP_TO",

"taxNumber": "N",

"taxNumberTypeCode": "PISContributor"

},

{

"locationType": "SHIP_TO",

"taxNumber": null,

"taxNumberTypeCode": "taxDeclarationType"

}

]

}

],

"debug": "0",

"chaveBanco": "481446_Homolog"

},

"taasResponse": {

"total": "2040.318000000000",

"subTotal": "2040.318000000000",

"totalTax": "9.715800000000",

"taxLines": [

{

"id": "000010",

"totalTax": "428.460000000000",

"taxcode": "6911",

"taxValues": [

{

"rate": "0.0000",

"taxable": "0.000000000000",

"name": "Imposto sobre Produtos Industrializados",

"value": "0.000000000000",

"exemptedBasePercent": "0.0000",

"exemptedBaseAmount": "2040.318000000000000",

"otherBaseAmount": "0.000000000000",

"taxTypeCode": "IPI",

"taxAttributes": [

{

"attributeType": "CENQ",

"attributeValue": "999"

},

{

"attributeType": "CST",

"attributeValue": "53"

},

{

"attributeType": "legalProvision1",

"attributeValue": "Art. 18, da Lei nº 13.097/2015 c.c. art. 7º da Lei 7.798/1989"

},

{

"attributeType": "legalPCode1",

"attributeValue": "220017"

}

]

},

{

"rate": "4.0000",

"taxable": "2040.317468354340",

"name": "Imposto sobre Comercialização de Mercadorias e Serviços",

"value": "81.610000000000",

"exemptedBasePercent": "0.0000",

"exemptedBaseAmount": "0.000000000000",

"otherBaseAmount": "0.000000000000",

"taxTypeCode": "ICMS",

"taxAttributes": [

{

"attributeType": "CST",

"attributeValue": "00"

},

{

"attributeType": "baseDetermination",

"attributeValue": "3"

},

{

"attributeType": "legalProvision2",

"attributeValue": "DispLeg=Art. 27, I, `a` do RICMS/PI, Art. 21, I, `c` do RICMS/PI"

},

{

"attributeType": "legalPCode2",

"attributeValue": "230210"

}

]

},

{

"rate": "21.0000",

"taxable": "2040.320000000000",

"name": "ICMS-DP",

"value": "346.850000000000",

"exemptedBasePercent": "0.0000",

"exemptedBaseAmount": "0.000000000000",

"otherBaseAmount": "0.000000000000",

"taxTypeCode": "ICMS-DP",

"taxAttributes": [

{

"attributeType": "legalProvision1",

"attributeValue": "Livro I, Art. 27, I e Apêndice I, Seção I, item XI do RICMS"

}

]

},

{

"rate": "0.0000",

"taxable": "0.000000000000",

"name": "Programa de Integração Social",

"value": "0.000000000000",

"exemptedBasePercent": "0.0000",

"exemptedBaseAmount": "0.000000000000",

"otherBaseAmount":"1611.850800000000000",

"taxTypeCode": "PIS",

"taxAttributes": [

{

"attributeType": "CST",

"attributeValue": "49"

},

{

"attributeType": "legalProvision1",

"attributeValue": "Art. 1º da Lei nº 10.637/2002"

},

{

"attributeType": "legalPCode1",

"attributeValue": "230278"

}

]

},

{

"rate": "0.0000",

"taxable": "0.000000000000",

"name": "Contribuição para o Financiamento da Seguridade Social",

"value": "0.000000000000",

"exemptedBasePercent": "0.0000",

"exemptedBaseAmount": "0.000000000000",

"otherBaseAmount": "1611.850800000000000",

"taxTypeCode": "COFINS",

"taxAttributes": [

{

"attributeType": "CST",

"attributeValue": "49"

},

{

"attributeType": "legalProvision1",

"attributeValue": "Art. 1º da Lei nº 10.833/2003"

},

{

"attributeType": "legalPCode1",

"attributeValue": "230279"

}

]

}

]

}

],

"date": "2023-10-31T20:39:17.4599094+00:00",

"genericInfo": "NvProdUniPC=7.675480000000|idCenario=2141379|UFO=rj|UFD=pi|natOp=771|perfilorig=2|perfildest=6|versao=6.16|",

"partnerName": "Systax versao=6.16"

},

"searchedProfile": {

"itemtype": "M",

"saleorPurchase": "S",

"operationnaturecode": "2GT",

"ownproduction": "N",

"usage": "C",

"usagePurpose": "",

"shipfromuf": "RJ",

"shiptouf": "PI",

"materialorigin": "2",

"shipfromcountry": "BR",

"shipfromipicontributor": "N",

"shiptoipicontributor": "N",

"shipfromtaxregimencode": "3",

"shiptotaxregimencode": null,

"shipfromibgecode": "3302254",

"shiptoibgecode": "2211001",

"shipfromie": "78863692",

"shipfromcnpj": "01358874001311",

"shiptocnpj": null,

"shipfromicmscontributor": "Y",

"shiptoicmscontributor": "N",

"shipfromicmsstcontributor": "Y",

"shiptoicmsstcontributor": "N",

"shipfromtaxdeclarationtype": "REAL PROFIT",

"shiptotaxdeclarationtype": null,

"shipfromcnae": "4646001",

"shiptocnae": null,

"shiptoisscontributor": "N"

},

"taxEngineRQ": {

"cabecalho": {

"usuario": "Teste1",

"senha": "*******",

"sessionID": "005056AB1BC71EDE9E8916260C04D7CA",

"sisOrig": "1",

"dtCalc": "2023-10-31",

"ufOrig": "RJ",

"ufDest": "PI",

"tpNF": "1",

"cnaeRem": null,

"cnaeDest": null,

"munOrig": "3302254",

"munDest": "2211001",

"impAtiv": "4",

"generico": null,

"chaveBanco": "481446_Homolog"

},

"itens": [

{

"id": "000010",

"natOp": "771",

"finalidade": "",

"perfilRem": "2",

"perfilDest": "6",

"cProd": "81720663",

"orig": "2",

"cEAN": "17500435036754",

"ncm": "30045030",

"extipi": "",

"vProdUni": "7.675480000000",

"qTrib": "210.000",

"vFrete": null,

"vSeg": null,

"vOutro": null,

"vDesc": null,

"pDesc": null,

"outrasDesp": null,

"pCredSN": "0",

"infCustoAquis": null,

"margemLucro": null,

"generico": null

}

]

},

"taxEngineRS": {

"itens": [

{

"id": "000010",

"cProd": "81720663",

"cest": "1300300",

"cfop": "6911",

"ncm": "30045030",

"extipi": null,

"pCredSN_resp": "0",

"custo_aquisicao": null,

"nvProdUni": "9.715800000000",

"cBenef": null,

"generico": "NvProdUniPC=7.675480000000|idCenario=2141379|UFO=rj|UFD=pi|natOp=771|perfilorig=2|perfildest=6|versao=6.16|",

"status": {

"cod": "0",

"msg": "Retornado com sucesso.",

"idIncidente": null

},

"nFe": {

"imposto": {

"icms": {

"icmS00": {

"orig": "2",

"cst": "00",

"modBC": "3",

"vBC": "2040.317468354340",

"pICMS": "4.0000",

"vICMS": "81.610000000000",

"pFCP": null,

"vFCP": null

},

"icmS10": null,

"icmS20": null,

"icmS30": null,

"icmS40": null,

"icmS51": null,

"icmS60": null,

"icmS70": null,

"icmS90": null,

"icmssN101": null,

"icmssN102": null,

"icmssN201": null,

"icmssN202": null,

"icmssN500": null,

"icmssN900": null,

"icmssN300": null,

"icmssN400": null

},

"ipi": {

"cEnq": "999",

"ipiTrib": null,

"ipint": {

"cst": "53"

}

},

"pis": {

"pisAliq": null,

"pisQtde": null,

"pisnt": null,

"pisOutr": {

"cst": "49",

"vBC": "0.000000000000",

"pPIS": "0.0000",

"qBCProd": null,

"vAliqProd": null,

"vPIS": "0.000000000000"

}

},

"pisst": null,

"cofins": {

"cofinsAliq": null,

"cofinsnt": null,

"cofinsOutr": {

"cst": "49",

"vBC": "0.000000000000",

"pCOFINS": "0.0000",

"qBCProd": null,

"vAliqProd": null,

"vCOFINS": "0.000000000000"

},

"cofinsQtde": null

},

"cofinsst": null,

"icmsufDest": {

"vBCUFDest": "2040.320000000000",

"vBCFCPUFDest": null,

"pFCPUFDest": null,

"pICMSUFDest": "21.0000",

"pICMSInter": "4.00",

"pICMSInterPart": "100.0000",

"vFCPUFDest": null,

"vICMSUFDest": "346.850000000000",

"vICMSUFRemet": "0.000000000000"

}

},

"infAdProd": "pFCP:0%;vFCP:R$0;valor_aproximado_tributos_estaduais=290.133144000000 valor_aproximado_tributos_federais=344.130145800000 vBCUFDest=2040.320000000000;pICMSUFDest=21.0000;pICMSInter=4.00;pICMSInterPart=100.0000;vICMSUFDest=346.850000000000;vICMSUFRemet=0.000000000000;IPI:Art;18, da Lei nº 13.097/2015 c.c;art;7º da Lei 7.798/1989;PIS:Art;1º da Lei nº 10.637/2002",

"infCpl": "DispLeg=Art. 27, I, `a` do RICMS/PI, Art. 21, I, `c` do RICMS/PI"

},

"conteudoAuxiliar": {

"cofinsCred": null,

"icmsCred": null,

"icmS_ANTECIPACAOCred": null,

"icmS_Antecipacao": null,

"ipiCred": null,

"pisCred": null,

"simulacaO_ICMS_ST": null,

"icmsDeson": null,

"icmsDifalContribuinte": null,

"funrural": null,

"icmsCombustiveis": null,

"dispositivoLegal": {

"dispositivoLegalICMS": "art. 4º, I do RICMS/RJ. Resolução do Senado Federal nº 13/2012",

"dispositivoLegalICMSST": null,

"dispositivoLegalIPI": "Art. 18, da Lei nº 13.097/2015 c.c. art. 7º da Lei 7.798/1989",

"dispositivoLegalPIS": "Art. 1º da Lei nº 10.637/2002",

"dispositivoLegalCOFINS": "Art. 1º da Lei nº 10.833/2003"

},

"creditoEspecial": null,

"precoTotalItem": null,

"cargaTributaria": null,

"creditoPresumido": null,

"margemLucro": null

},

"cTe": null

}

],

"icmsTot": {

"vBC": "2040.317468354340",

"vICMS": "81.610000000000",

"vICMSDeson": "0.000000000000",

"vFCPUFDest": "0.000000000000",

"vICMSUFDest": "346.850000000000",

"vICMSUFRemet": "0.000000000000",

"vFCP": "0.000000000000",

"vBCST": "0.000000000000",

"vST": "0.000000000000",

"vFCPST": "0.000000000000",

"vFCPSTRet": "0.000000000000",

"vProd": "2040.318000000000",

"vFrete": "0.000000000000",

"vSeg": "0.000000000000",

"vDesc": "0.000000000000",

"vII": "0.000000000000",

"vIPI": "0.000000000000",

"vIPIDevol": "0.000000000000",

"vPIS": "0.000000000000",

"vCOFINS": "0.000000000000",

"vOutro": "0.000000000000",

"vNF": "2040.318000000000",

"vServ": "0.000000000000",

"vTotTrib": "0.000000000000",

"vTeste": null

}

},

"ondemand": false,

"profileNotFound": false,

"usedProfile": {

"saleorPurchase": "S",

"operationnaturecode": "2GT",

"itemtype": "M",

"materialorigin": "0,2,3,4,5,7,8",

"ownproduction": "",

"usage": "C",

"usagePurpose": "",

"shipfromcountry": "",

"shipfromuf": "RJ",

"shiptouf": "",

"shipfromcnae": "",

"shipfromcnpj": "",

"shipfromie": "",

"shipfromibgecode": "",

"shipfromicmscontributor": "",

"shipfromicmsstcontributor": "",

"shipfromipicontributor": "",

"shipfromtaxdeclarationtype": "",

"shipfromtaxregimencode": "",

"shiptocnae": "",

"shiptocnpj": "",

"shiptoibgecode": "",

"shiptoicmscontributor": "N",

"shiptoicmsstcontributor": "",

"shiptoipicontributor": "",

"shiptoisscontributor": "",

"shiptotaxdeclarationtype": "",

"shiptotaxregimencode": "",

"natopicms": "771",

"finalidade": "",

"perfilrem": "2",

"perfildest": "6",

"chaveBanco": "481446_Homolog",

"tipoNF": "1",

"id": "7200",

"quantidadeNulos": 22

}

}

]

Conclusão

A API Trace é extremamente útil para a visualização completa do fluxo que envolve o Tass, pois através dela é possível verificar numa única chamada e retorno o processo completo com a chamada e retorno do Tass, a chamada e retorno do Motor e a Determinação de Perfil e isso facilita muito a análise do usuário.

| Versão do documento: 48 | Publicação: 11/17/2023 |